In the evolving world of algorithmic trading, precision and logic define success. Candle Power EA V1.0 MT4 stands out as a new-generation Expert Advisor engineered for traders who rely on structured, data-driven strategies rather than emotion. It’s designed to capture market inefficiencies by exploiting short-term reversals within the S&P 500 and related indices, using a disciplined mean-reversion framework that focuses on controlled entries and risk-managed exits.

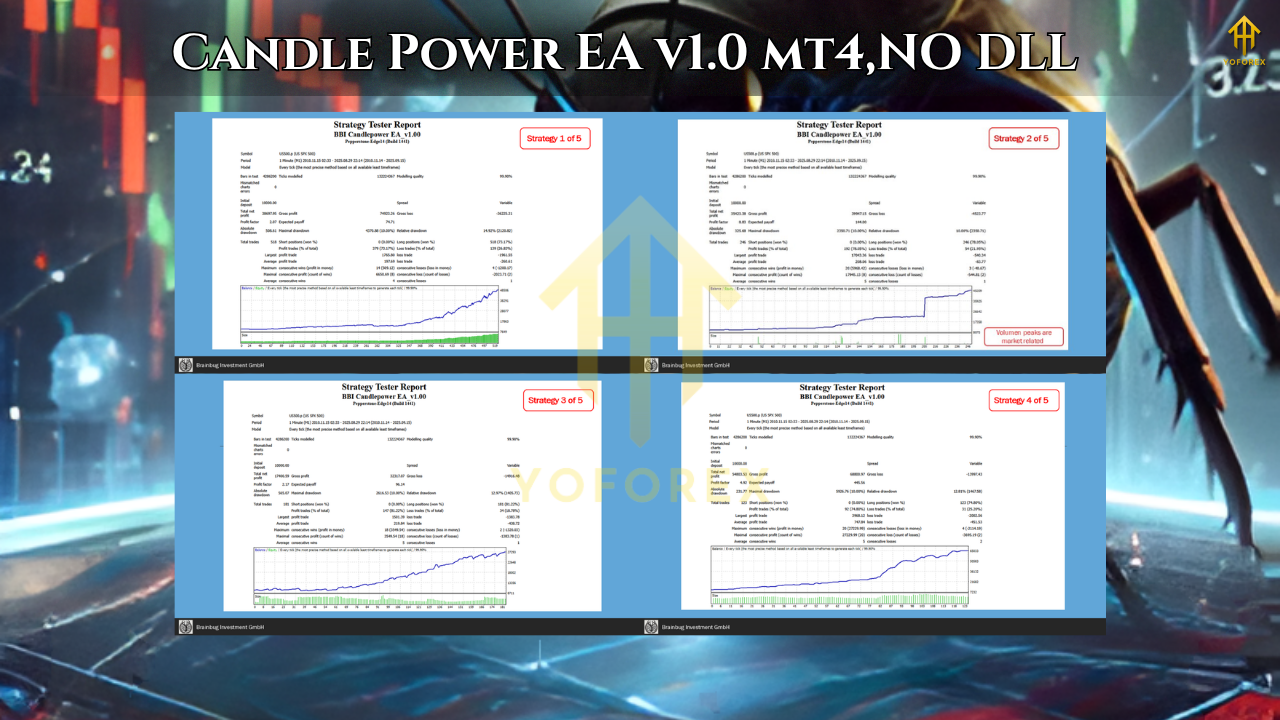

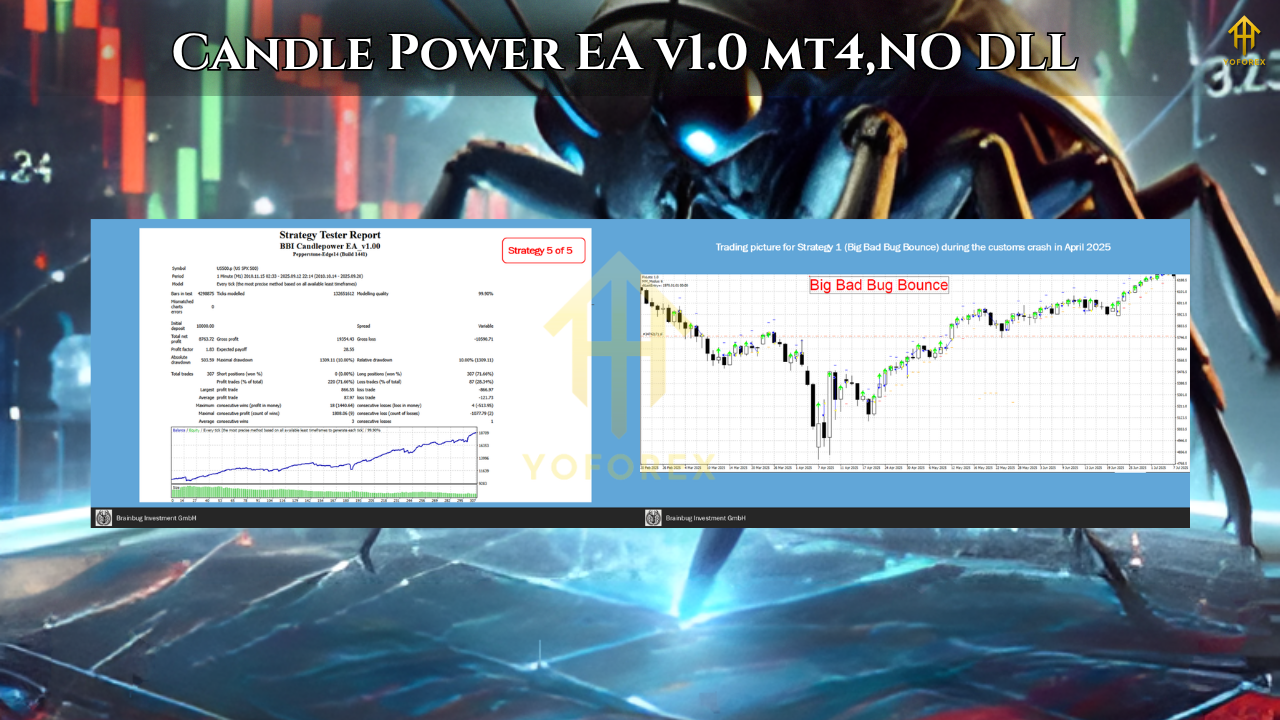

This EA isn’t another hype-based scalper or grid system. Instead, it delivers a balanced trading portfolio built on five independent strategy modules, each optimised to detect exhaustion points, recover from volatility shocks, and identify high-probability reversals.

Introduction: A Smarter Approach to Market Reversals

Markets often swing between greed and fear, creating sharp overbought or oversold phases. Candle Power EA V1.0 MT4 is developed to recognise these extremes and trade intelligently in the opposite direction. Its logic revolves around mean-reversion — the principle that prices tend to revert toward their average after significant deviations.

The EA operates on MetaTrader 4, a platform known for flexibility, and is especially effective on the S&P 500 index, although it can be adapted to other assets once properly optimised. Its architecture allows traders to diversify within a single EA, reducing dependency on one specific entry condition.

Core Architecture and Working Logic

Candle Power EA employs a multi-module system — a distinctive structure that divides the entire trading logic into five complementary modules. Each module works independently with unique filters, trade identifiers, and exit logic. Together, they form a diversified mean-reversion portfolio that balances performance and stability.

Every module targets different market behaviours:

- Some respond to volatility expansion and sudden sell-offs.

- Others focus on intraday exhaustion points or weekday-specific tendencies.

- All share one purpose — to identify high-probability turning zones without the use of martingale or grid recovery systems.

The entries are built around a proprietary Candle Power Indicator (CPI) that measures candle structure, volatility ratios, and reversal momentum. This indicator, in combination with RSI and volatility filters, ensures entries occur only when markets are extended enough to justify a mean-reversion play.

Risk Management and Money Control

Candle Power EA V1.0 MT4 includes several risk management layers:

- Each strategy module uses its own stop-loss and take-profit logic.

- Trailing-stop and break-even features are applied dynamically depending on volatility conditions.

- Position sizing can be adjusted through eight different money-management methods, allowing traders to set fixed lots or proportional risk models.

These mechanisms eliminate the use of dangerous compounding systems and instead focus on steady, consistent growth through capital preservation.

Another highlight is its focus on stress-phase trading — the EA often finds opportunities during turbulent periods when fear dominates. Instead of avoiding volatility, it converts those extremes into entries aligned with the natural rebound behaviour of large-cap indices.

Performance Foundation and Testing Philosophy

This Expert Advisor was designed with transparency in mind. Its developer emphasises long-term backtesting covering over 15 years of S&P 500 historical data. The testing procedure replicates tick-level accuracy, ensuring that slippage, spread, and execution conditions resemble live trading environments.

Instead of promising instant profits, Candle Power EA aims for long-term equity curve stability. The strategy’s design ensures that even during losing streaks, exposure remains minimal thanks to strict position caps and controlled drawdowns.

The five modules work in parallel, each contributing to a smoother equity curve — one module might capture rebounds after panic drops, while another capitalises on mean pullbacks after strong rallies.

Practical Implementation Guide

- Installation and Setup

- Copy the EA file into your

MQL4/Expertsdirectory and restart MT4. - Attach it to your preferred S&P 500 chart (e.g., US500, SPX500, or equivalent).

- Load the preset configuration provided within the package.

- Account Size and Broker Type

- Use a broker offering tight spreads on S&P 500 CFDs or futures.

- The EA performs best with low latency and minimal slippage environments.

- A minimum capital of around $1000–$2000 is recommended for conservative risk allocation.

- Timeframe

- The strategy works primarily on the H1 timeframe, capturing intraday mean reversions with manageable exposure windows.

- Testing Before Live Deployment

- Always test the EA on a demo account first to observe module behaviour under live-feed conditions.

- Once verified, deploy on a VPS to maintain 24/7 uptime and consistent execution.

Why Candle Power EA Stands Out

1. Modular Flexibility

Most EAs rely on one rigid logic; Candle Power EA’s modular system gives it adaptability. Users can enable or disable specific strategies to fine-tune the overall portfolio performance.

2. Non-Martingale and Non-Grid Approach

The EA completely avoids doubling positions or using grids to chase losses. Each trade is independent, risk-defined, and statistically justified.

3. Detailed Documentation and Support

It comes with comprehensive user documentation and preset files to help even beginners understand installation, configuration, and optimization.

4. Designed for Volatile Markets

Many EAs fail when volatility spikes. Candle Power thrives during those conditions by capturing exaggerated price movements and turning them into profitable reversions.

5. Consistent Engineering Philosophy

The EA is built for traders who think in probabilities rather than predictions — focusing on process and discipline over luck.

Best Use Cases

- Prop-firm traders who need stable and rule-compliant systems without aggressive risk stacking.

- Long-term investors looking to diversify their portfolio with a quantitative mean-reversion component.

- New algorithmic traders who prefer ready-to-use yet customizable systems.

- Experienced programmers who wish to study modular EA architecture and adapt it for other markets.

Trading Philosophy: The Power Behind Candle Logic

The candle-based logic revolves around analysing recent bar structures — size, direction, and range expansion — to detect when price momentum becomes unsustainable. Once a candle pattern meets the over-extension threshold, the system prepares a reversal entry aligned with the CPI filter.

This philosophy turns ordinary candle data into actionable signals. It helps the EA identify exhaustion points before retail traders notice, allowing for precise counter-trend entries with a high reward-to-risk ratio.

Advantages at a Glance

- Diversified mean-reversion portfolio

- Five independent trading modules

- Transparent backtesting over 15 years

- No martingale or grid recovery

- Compatible with most S&P 500 index symbols

- Adaptive risk and exit logic

- Works during market stress events

- Straightforward setup for MT4 users

Final Thoughts

Candle Power EA V1.0 MT4 delivers what most traders actually need — discipline, transparency, and controlled performance. It transforms volatility into opportunity through a clear, repeatable framework. Instead of promising unrealistic gains, it offers reliability across varying market conditions.

For traders seeking a sustainable automated system rather than a quick-profit gimmick, Candle Power EA provides a practical, research-backed solution. By combining independent modules, dynamic filters, and intelligent exits, it sets a high standard in systematic mean-reversion design.

Before going live, always test thoroughly, monitor results, and update presets as markets evolve. Automation doesn’t eliminate risk — it structures it. And Candle Power EA V1.0 MT4 does exactly that.

Comments

Leave a Comment